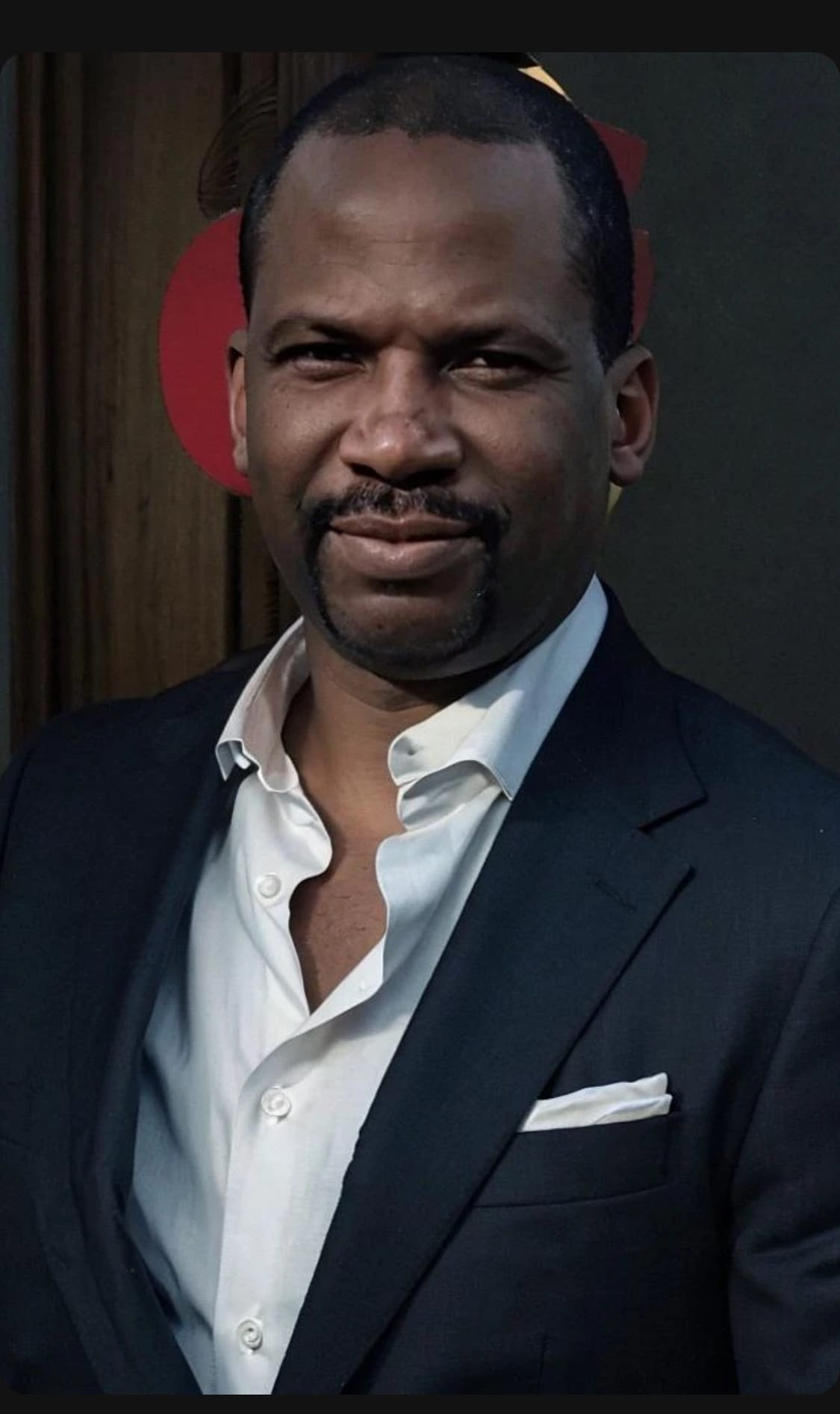

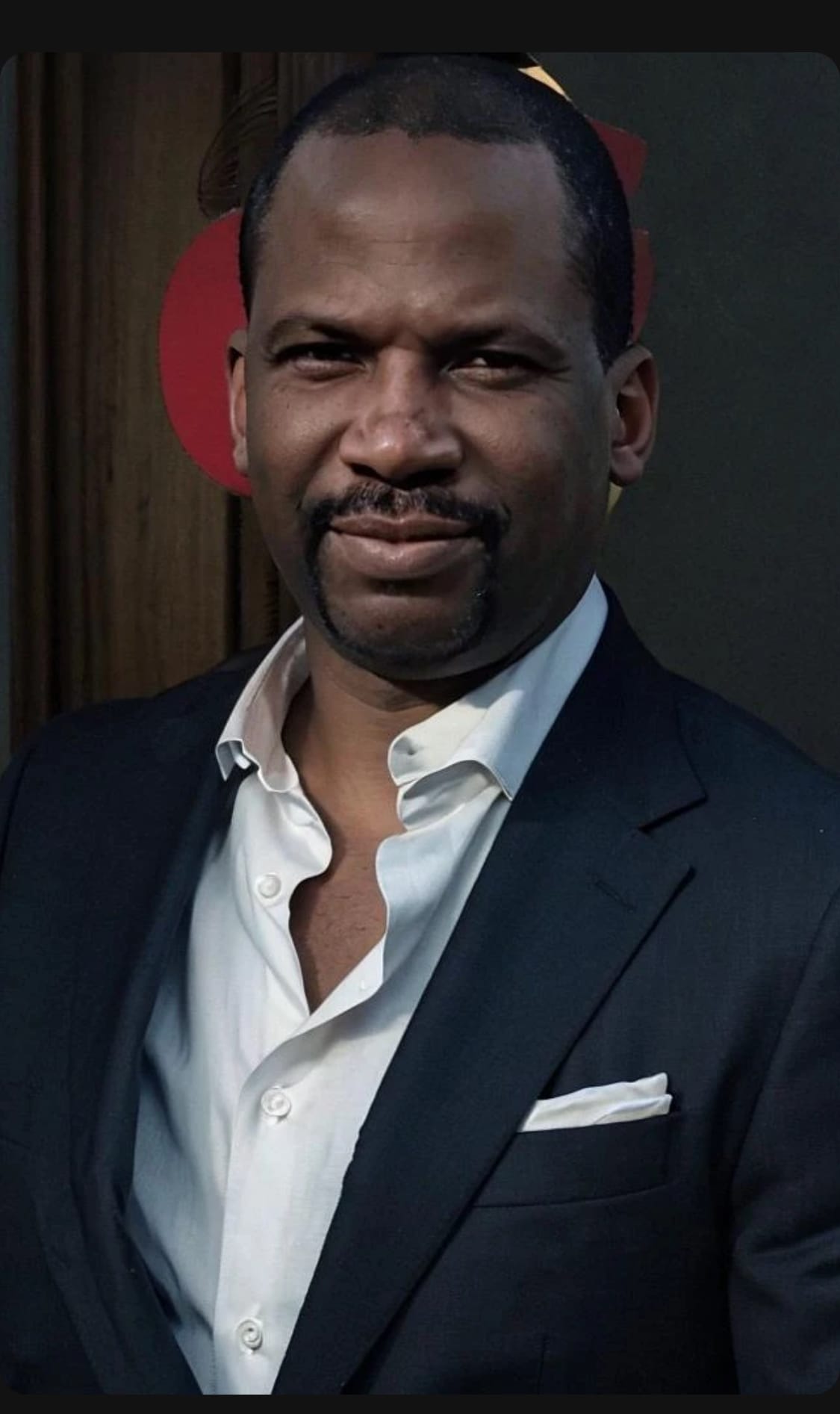

I’m Stephan H. Brewer, CTRS, JSM Tax, NTPI Fellow, Founder of Legacy Tax Resolution Services, LLC and a Certified Tax Resolution Specialist. After 20 years in the U.S. Air Force as a highly decorated Command Controller, I transitioned into accounting and tax—building and scaling a multi-office practice in the Phoenix metro area.

Over time, tax resolution became our primary focus because we saw firsthand how often clients walked in with avoidable IRS and state tax issues. I earned a Master’s Degree in Tax and pursued specialized industry training to deliver real solutions—not guesswork.

Today, our firm is staffed with seasoned professionals, including CPAs, attorneys, former IRS revenue officers, and dedicated tax resolution specialists, allowing us to handle nearly any IRS or state tax scenario. We pride ourselves on personalized service, frequent communication, and results, so our clients can finally breathe again and sleep better at night.

When I’m not fighting tax battles, I’m spending time with family, traveling, or racing my off-road truck in the desert—because apparently I like high-stakes situations in all areas of life.