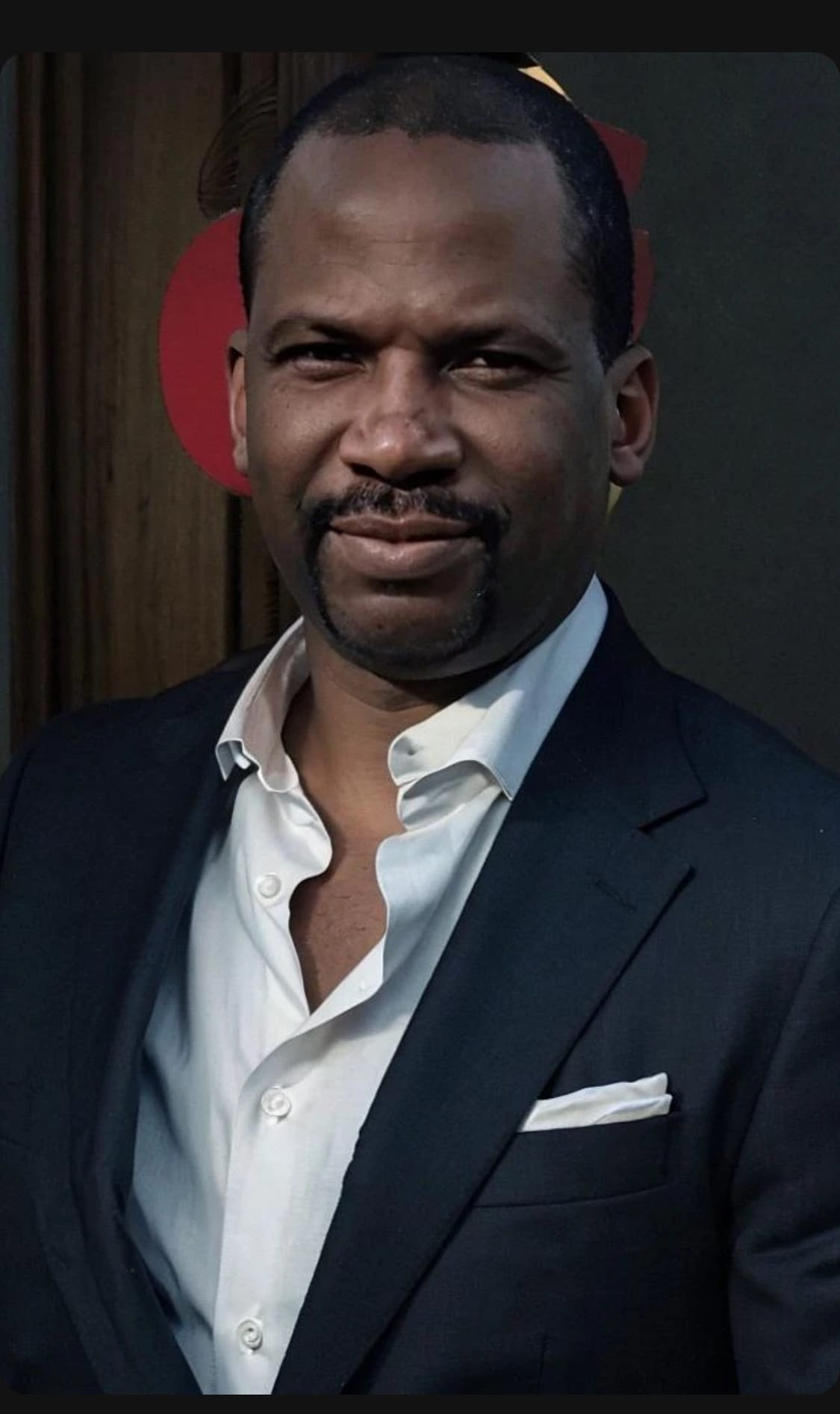

Most firms chase the top line. I fortify the bottom line. I work with CEOs and owners to surface hidden cash flow, cut friction, and raise EBITDA—zero new overhead. My playbook lives outside the usual CPA/CMO/board lens: benefits restructuring, vendor fee forensics, payroll tax savings, R&D credits, and invitation-only designs like ER³ Tax Unicorn™ (with independent actuarial oversight under §831(a)). I’m featured on NBC, News Talk, ABC, MarketWatch, and Fox News—not for hype, but for outcomes. If you want resilient growth, fewer leaks, and decisions made in plain English, I’m your guy.

About Me

Who Am I?

Mission Statement

Services

Services

- 💰 Found Money Audit — uncover hidden cash flow.

- 🧾 Payroll Tax Savings Plan — raise net pay with no new overhead.

- 🧪 R&D Tax Credit Studies — document, file, maximize credits.

- 🦄 ER³ Tax Unicorn™ Design — deductible premiums + Roth-style growth.

- 🛡️ §831(a) Reinsurance Setup — risk transfer with actuarial oversight.

- 🤝 Buy–Sell Funding Strategy — continuity if a partner exits.

- 📈 EBITDA Lift Roadmap — quick wins + operating cadence.

- ⏱️ Working Capital Optimization — speed cash cycles, cut friction.

- 🔐 Crypto Literacy 101 — safety-first education, no hype.

- ✅ Implementation & Compliance — we build, you benefit.

- 🎟️ Invitation-Only Workshops — ER³ Tax Unicorn™ sessions.

- 💊 $0 Rx & Wholesale Benefits — zero-cost meds + transparent pricing.

- 🏥 Health Plan Cost Disruption — slash bloated group health spend.

Why Choose Us

Certificates/Licenses

FAQ's

1: Q: What makes the eR3 Plan™ different from traditional retirement strategies?

A: It combines private insurance with a self-directed Roth IRA or Solo Roth 401(k) to super fund retirement with tax-advantaged dollars—something most CPAs or advisors won’t show you.

2: Q: What are the main perks of participating?

A: You gain tax-advantaged growth, asset protection, risk coverage, and the ability to transfer wealth to family-TAX FREE

3: Q: How flexible is the program?

A: You can fund through a Solo Roth 401(k) or Roth IRA, cancel at any time, and ownership can even include family members—making it a powerful tool for tax-efficient wealth transfer.

4: Who qualifies for R&D tax credits?

More companies than think they do—software, manufacturing, ecommerce, even food/retail if you’re improving products or processes. We run a free benefits evaluation to confirm eligibility.

5: What’s your process?

Initial consult → detailed assessment of activities/expenses → custom evaluation of potential credits → hands-on guidance through filing for maximum benefit.

6: What kind of outcomes do similar businesses see?

Published examples include: $375K for a $3M app firm, $500K for a $20M agency, ~$1M for a $63.1M manufacturer, $2.2M for a $31M ecommerce brand, and $1.3M for a $20M retailer. Your mileage varies, but the upside is real.

7: What do you actually change in my group health plan to cut costs?

We replace bloated, mark-up heavy plans with wholesale pricing, zero-cost Rx options, and remove the middleman broker structure that hides fees and conflicts. We also audit your current plan and contracts for waste.

8: How much are most companies overpaying?

Typically 20–40% on health benefits—because that’s how the system’s built. We’ll show you where the bloat lives in black and white.

9: Is this ERISA-compliant? I don’t want an audit headache.

Yes. Our approach is designed to be ERISA-compliant and to strengthen your fiduciary oversight of brokers and vendors. Translation: lower cost, tighter compliance.

2D Video Explainer

Press/Media

Events

Blog

Stop Chasing Only the Top Line: Your “Found Money” Is Hiding in Plain Sight

Announcements

Clients

Resume

Experience

Education

Property Listing

Inventory

No additional services available at the moment.

Reviews

“Dan found money we didn’t know existed. Health plan overhaul = less spend, happier employees, and $0 meds on key scripts. Straight talk, fast wins.”

— Maria Lopez, HR Director, SlateWorks Manufacturing

“Our CPA missed R&D for years. Dan’s team documented it in plain English and we captured meaningful credits without disrupting sprint cycles. Cash back, zero drama.”

— Kevin Tran, CTO, NorthBridge Software

“I thought our brokers were fine—turns out they were expensive. Dan re-papered contracts, killed junk fees, and gave us a clean dashboard. EBITDA up, headaches down.”

— Alicia Greene, COO, Harborline Logistics

“The payroll tax savings plan was a layup. Employees took home more while our costs went down. Dan made compliance simple and the rollout painless.”

— Greg Martin, CFO, Radiant Home Services

We came for cost control, stayed for strategy. Dan’s ‘Found Money’ audit funded our expansion without new debt. Best outside advisor we’ve hired.”

— Priya Desai, Founder & CEO, Lumen Retail Group

Ready When You Are

Calendar

Set an Appointment With Me

Click Meeting Link to Check My Availability

Menu

Booking

No booking options available at the moment.

Join My Team

No team members available at the moment.

Additional Services

Home Solar

No home solar services available at the moment.

Resiliency Products

No Resiliency Products available at the moment.

Video Links

No Video Links available at the moment.