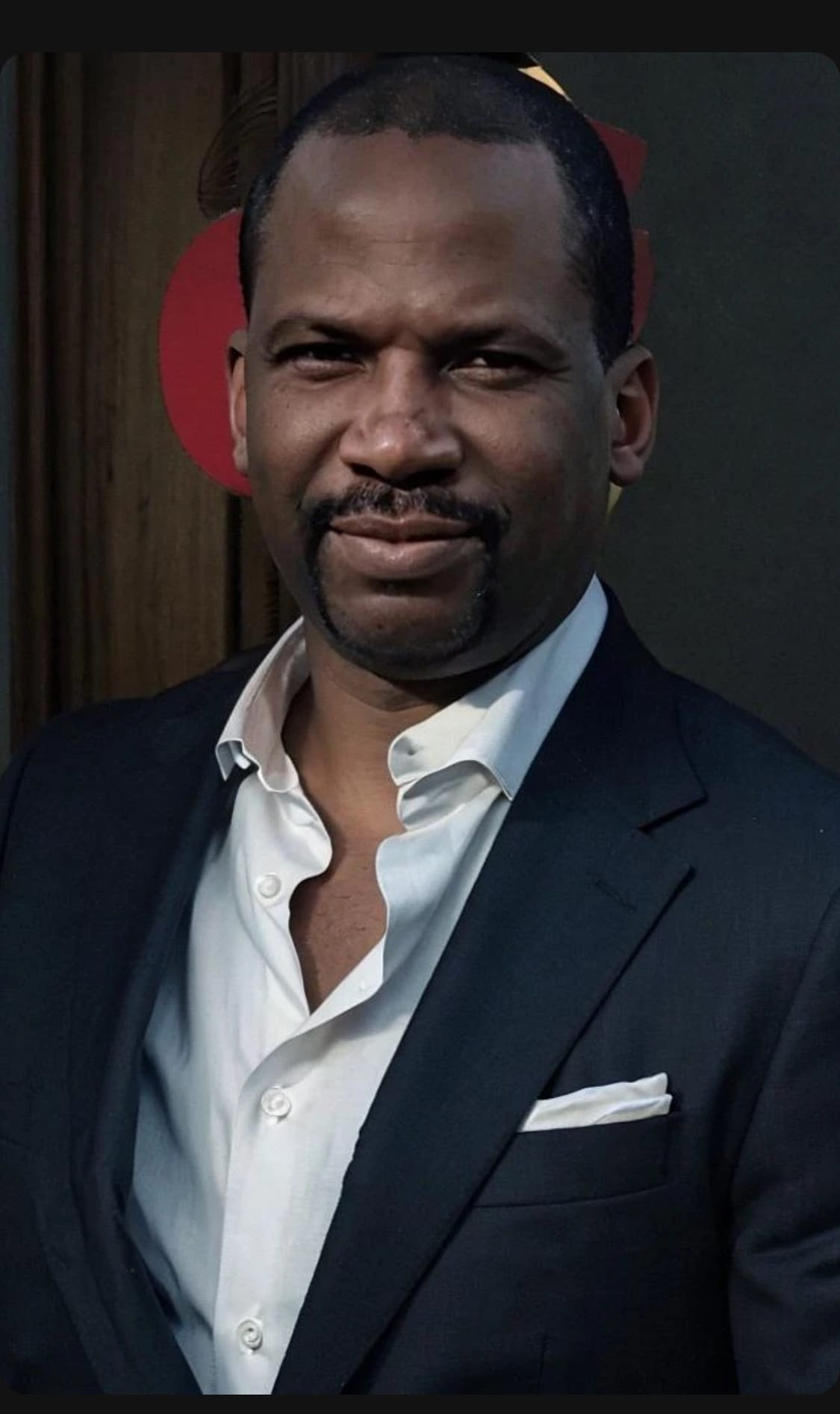

I am a dedicated professional committed to helping individuals and families find the right solutions to protect what matters most. With a strong focus on integrity, education, and personalized service, I take pride in guiding clients through important decisions with clarity and care.

Over the years, I have built lasting relationships by listening first, understanding unique needs, and delivering strategies that create peace of mind and long-term security. Whether it’s planning for the future, protecting a family’s well-being, or finding ways to navigate today’s challenges, I approach every client with the same dedication and respect I would give my own family.

Outside of work, I value community, connection, and continuous growth. My mission is simple: to serve with honesty, to lead with compassion, and to ensure every person I work with feels supported and confident in their choices.